Hedge money, noted for their intense expenditure strategies, are at the moment navigating a tumultuous market landscape characterised by heightened volatility. This natural environment has posed significant problems, persuasive fund administrators to reassess their approaches. Notably, the prominence of quick positions has come to the forefront, specifically with stocks like AMC and GameStop, that have experienced extraordinary rate fluctuations pushed by retail Trader enthusiasm. These developments underscore the complexities hedge resources face as they harmony risk and opportunity inside a rapidly modifying market. The implications for traders are profound, as the procedures utilized by hedge money can appreciably impact market dynamics and person investment outcomes. As we delve further into this subject, We'll take a look at how these difficulties form the hedge fund sector and whatever they suggest for investors wanting to navigate this unpredictable terrain successfully.

current market downturns have raised severe concerns regarding the security of hedge cash, here as these cash usually use superior-danger tactics which might be seriously impacted by unexpected declines in asset values. The volatility noticed during the marketplaces has resulted in elevated scrutiny of hedge fund effectiveness, with a lot of traders questioning the resilience of their portfolios. Potential liquidations pose a substantial threat, as compelled providing of property can additional depress charges, developing a vicious cycle that undermines fund security. This circumstance not just impacts the money on their own but will also has broader implications for the industry, as huge-scale liquidations may result in heightened volatility and uncertainty. As hedge money grapple with these problems, the interplay in between sector dips and volatility will become progressively essential, highlighting the need for adaptive procedures to safeguard investments and sustain Trader self confidence in an unpredictable money landscape.

shares like AMC and GameStop have emerged as focal factors for each retail and institutional traders, capturing widespread attention due to their extreme price tag fluctuations. These stocks are becoming emblematic in the battle between retail traders and hedge resources, specially as retail investors have rallied about them, driving selling prices to unprecedented ranges. The volatility affiliated with these shares has experienced considerable repercussions for hedge resources, a lot of which held significant small positions, betting towards their good results. As price ranges soared, these funds confronted mounting losses, forcing some to deal with their shorts at a decline, even further fueling the upward momentum. this case highlights the inherent hazards hedge resources come across when engaging In a nutshell promoting, specifically in a market place the place retail sentiment can radically change inventory valuations. the continuing saga of AMC and GameStop serves as being a cautionary tale about the unpredictable nature of buying a risky surroundings.

Margin phone calls manifest when the value of the Trader's margin account falls underneath the broker's needed minimal, prompting the need For extra money or even the liquidation of belongings. For hedge funds, margin calls can have severe implications, as they typically operate with elevated leverage to amplify returns. Historical illustrations, including the collapse of Aros, illustrate the devastating effects of margin calls, wherever cash have been forced to liquidate positions at unfavorable costs, resulting in substantial losses. Elevated leverage ranges boost the likelihood of forced liquidations, specially in risky marketplaces wherever asset values can fluctuate considerably. When hedge funds are not able to fulfill margin prerequisites, They could be compelled to sell off belongings speedily, exacerbating marketplace declines and even more impacting their portfolios. This cycle of forced liquidations not simply threatens The steadiness of personal funds but could also contribute to broader market instability, highlighting the dangers related to significant leverage in hedge fund operations.

The opportunity for short squeezes poses a significant danger for hedge funds, specifically when sudden value increases come about in heavily shorted stocks. When costs rise sharply, hedge funds that have bet versus these shares might be pressured to cover their limited positions to Restrict losses, typically leading to even further price tag escalations. This dynamic can develop a suggestions loop, wherever the necessity to obtain back again shares drives price ranges even larger. Retail buyers have ever more coordinated efforts to initiate brief squeezes, as viewed in the circumstances of AMC and GameStop, demonstrating their ability to influence marketplace actions and challenge institutional buyers. The implications of these coordinated steps might be profound, leading to significant losses for hedge funds caught inside the squeeze. In addition, the unpredictable mother nature of closely shorted stocks during market place downturns provides One more layer of complexity, as volatility can exacerbate the challenges linked to limited promoting, leaving hedge cash at risk of immediate and unforeseen rate shifts.

Mumu is happy to introduce an enticing promotional give for new customers, giving the opportunity to obtain up to five free shares upon signing up. This marketing not merely serves as an incredible incentive to affix the System and also will allow people to kickstart their financial investment journey with beneficial property correct from the start. Mumu enhances buyers' portfolios by providing a various range of investment decision selections, coupled with aggressive desire costs which can help improve their prosperity eventually. that has a person-helpful interface and strong resources for tracking investments, Mumu empowers men and women to create educated decisions and improve their economical tactics. that is a fantastic moment for likely investors to seize the opportunity and make use of Mumu's marketing offer, location the phase for An effective investment experience. Don’t miss out on out on this chance to boost your portfolio and embark in your monetary journey with Mumu!

Hedge resources are more and more shifting in the direction of options trading techniques, as this strategy enables them to leverage capital more efficiently whilst handling risk exposure. By utilizing alternatives, hedge funds can make customized expense procedures that enhance returns without necessitating significant capital outlay. nonetheless, this shift also raises prospective dangers for retail investors who may possibly try and observe hedge fund strategies devoid of fully comprehending the complexities involved. alternatives investing may be intricate, and missteps can lead to substantial losses, particularly in unstable markets. as a result, it really is very important for retail traders to grasp the fundamentals of possibilities buying and selling just before diving in, given that the dynamics of these instruments can significantly affect expense results. inside a risky market place, comprehending options trading will become even more very important, mainly because it can provide opportunities for hedging in opposition to downturns or capitalizing on value actions. As hedge resources embrace these techniques, retail buyers need to strategy them with caution and knowledgeable Perception.

GameStop's existing money standing demonstrates notable improvements, specially in its economic metrics and money reserves, that have strengthened in latest quarters. the corporate has built strides in reducing financial debt and maximizing liquidity, positioning itself far more favorably inside a aggressive retail landscape. As GameStop prepares to release its upcoming quarterly success, these figures are going to be critical in shaping Trader sentiment. constructive earnings studies could bolster self-confidence among both equally institutional and retail investors, signaling a potential turnaround for the company. Furthermore, the increasing interest inside the gaming sector and GameStop's strategic initiatives to diversify its offerings may well bring in extra expense. These developments could produce a positive atmosphere for renewed interest from the inventory, as buyers look for opportunities in a corporation which has shown resilience and adaptability. Overall, GameStop's money improvements along with the anticipation encompassing its quarterly final results could pave how for a more optimistic outlook between traders.

Renaissance Technologies, a outstanding hedge fund noted for its quantitative buying and selling methods, has taken a cautious still strategic solution about its involvement with AMC and GameStop. not too long ago, the company has elevated its share positions in these intensely shorted shares, signaling a possible change in its investment tactic. This shift raises the potential for a short squeeze, as the combination of Renaissance's obtaining energy and the present significant limited desire could develop upward strain on inventory rates. Such a state of affairs may lead to significant current market volatility, impacting the two retail and institutional traders. The implications of Renaissance's investments are profound, as their actions may possibly influence industry sentiment and buying and selling dynamics. As current market members carefully keep track of these developments, the interaction between Renaissance's techniques and also the broader sector could condition investment decisions and highlight the continued complexities of buying and selling in risky environments like People bordering AMC and GameStop.

The involvement of latest institutional investors, for instance Madrick cash and Discovery funds, has drastically impacted AMC's stock performance, bringing renewed awareness and believability to the corporate. Their expense signifies self confidence in AMC's likely for recovery and advancement, which could positively impact industry sentiment. These companies generally utilize strategic strategies that may greatly enhance AMC's operational abilities, like optimizing economical management and Discovering progressive enterprise designs. By leveraging their abilities and means, these institutional traders may perhaps support AMC navigate worries and capitalize on rising prospects within the entertainment sector. In addition, the presence of institutional buyers can attract more curiosity from other marketplace members, creating a ripple impact that bolsters Trader self esteem. As AMC proceeds to adapt to altering current market ailments, the backing of founded institutional buyers could Perform an important job in shaping its foreseeable future trajectory and stabilizing its inventory general performance amidst ongoing volatility.

In summary, the discussion highlighted many important factors regarding hedge resources and their impact that you can buy, specially the numerous pitfalls they encounter in volatile environments. Hedge funds usually use high-leverage tactics, producing them at risk of sudden current market shifts, which can cause margin phone calls and compelled liquidations. Moreover, the rise of retail buyers as well as the possible for short squeezes have further more complicated the landscape for these cash. As we navigate these complexities, It truly is essential for investors to stay knowledgeable about industry tendencies as well as evolving strategies of hedge money. We motivate you to subscribe for more insights and updates on these essential subject areas. Your engagement is effective, so please share your feelings and ordeals inside the remarks down below. Permit’s foster a community of informed traders who can navigate the troubles and alternatives presented by these days’s dynamic market.

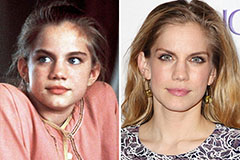

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!